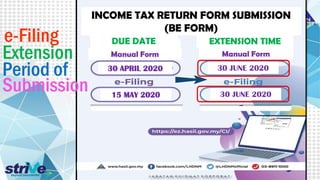

Go to Payroll Payroll Settings Form E. If you are a salaried employee without business income the two dates you need to know are 30 April for manual filing and 15 May for e-filing.

Kuala Lumpur 02 Ogos 2022 - Lembaga Hasil Dalam Negeri Malaysia HASiL dengan kerjasama Chartered Tax Institute of Malaysia CTIM hari ini menganjurkan Persidangan Percukaian Kebangsaan 2022 National Tax Conference 2022 NTC 2022 secara bersemuka serta dalam talian menerusi platform aplikasi Zoom.

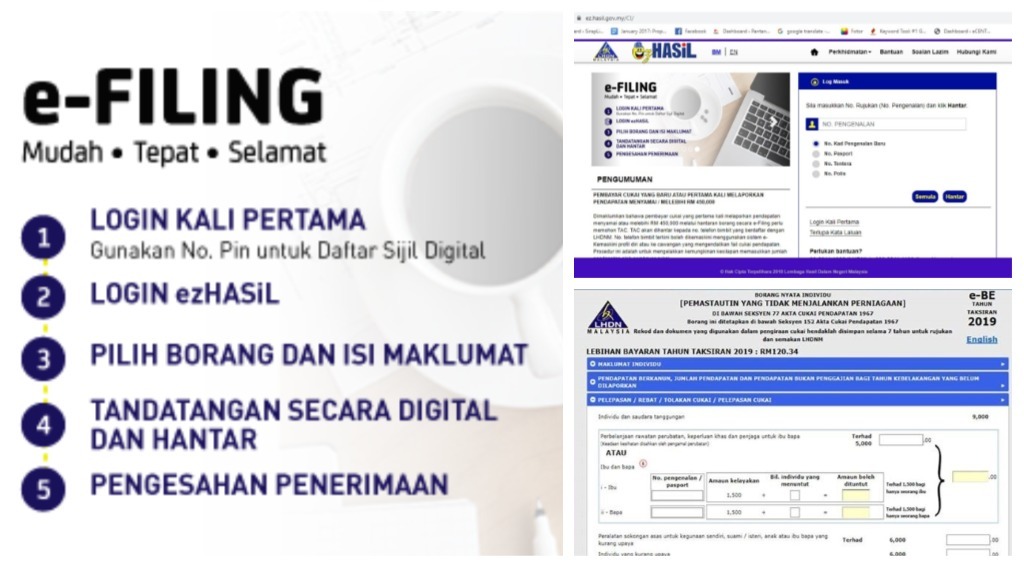

. Electronic filing Form e-E. EzHASiL System will display screen as below. 9 Steps to follow in LHDN E-Filing.

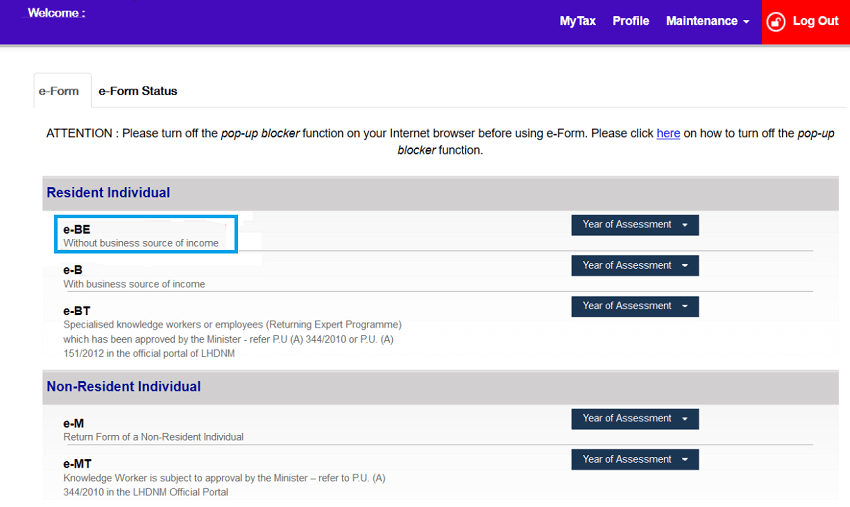

Register at the nearest IRBM Domestic Revenue Council of MalaysiaLHDN Lembaga Hasil Dalam Negeri or register online at hasilgovmyProvide copies of these. Click on e-Form link under e-Filing menu. IRBM LHDN will not entertain or accept any companies E filling 2021 that submit their Form E by hand or by mail.

The reason is that employers who are not companies have the choice to send in Form E through e-Filing or paper form. 94 Updating personal and income details. Select the Form CP55D and complete the pdf form.

Organizational e-Filing OeFUser Guide - Roaming PKI. Login Tax Agent User Guide. Chances are you wont have to report the payment you received on your state tax return but.

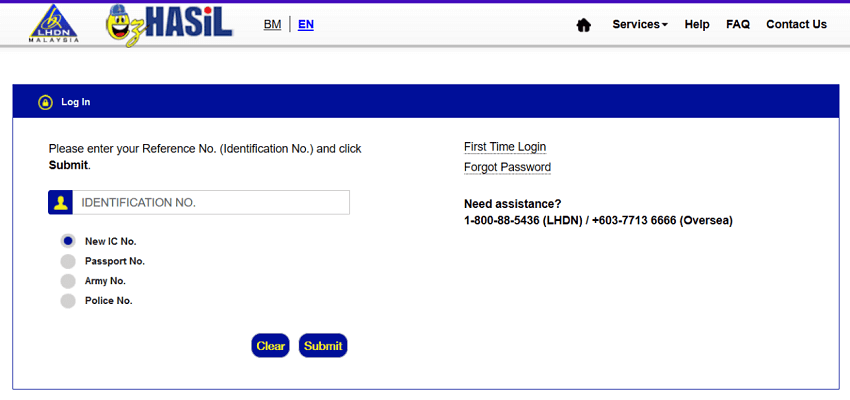

Types of e-Filing user New User First Time User need to register Digital Certificate to obtain digital signature Users with VALID Digital Certificates within 3 years Login e- Form Users with INVALID Digital Certificates more than 3. Click on e-Filing PIN Number Application on the left and then click on Form CP55D. Scroll to the bottom and click Next.

You might have heard that LHDN does not accept manual submissions from companies anymore yet the deadline for it is still there. 95 Understanding Tax Relief. 93 Starting the e-filing process.

If you do have business income then you have more leeway 30 June for manual filing and 15 July for e-filing. E05-01 Garden Shoppe One City Jalan USJ 251C SUBANG JAYA Selangor 47650 Malaysia. Click on Permohonan or Application depending on your chosen language.

Paling sesuai dengan paparan resolusi 1024 x 768. And register for Digital Certificate Login and Complete Online Form e-BE. Hak Cipta Terpelihara 2018 Lembaga Hasil Dalam Negeri Malaysia Hak Cipta Terpelihara 2018 Lembaga Hasil Dalam Negeri Malaysia.

Back in the good old days you could get through this step by providing a scanned image of your IC via online request or even a fax but not anymore. To prepare Form E for printing for electronic filing you can refer to the guide below or follow these steps. Cross-check all E forms information to.

91 Starting an application. For Year Assessment 2021 via e-Filing. Up to 24 cash back keeping you away from Infographic below will guide youFirst timer easy guide filing fees 2019Registered at LHDNJe you are newly taxed you must register an income tax number.

Lhdn e-filing guide for e-Be 1. Blog draft LHDN e-Filing Guide For Clueless Employees. User Manual e-Form ezHASiL version 33 User Manual e-Form ezHASiL version 33 8 14 e-Form Services screen will be displayed when users successfully login ezHASiL as below.

You can get it from the nearest LHDN branch office or apply online via the LHDN Customer Feedback website. Fill in the form with the required information. That means you must electronically file your taxes or have your tax preparer send them or mail them to be stamped on the due date.

E-Filing Submission Period of Extension INCOME TAX RETURN FORM SUBMISSION BE FORM DUE DATE EXTENSION TIME Manual Form Manual Form 15 MAY 2020 30 JUNE 202030 APRIL 2020 30 JUNE 2020 2. When its time to wax poetic and. 71 Total income Tax exemptions Taxable income.

Im a complete noob when it comes to doing anything hands-on. Click Create Form E for 2021. Challenge Phrase Change User Guide.

96 Checking your summary. Select applicable form type and Year of Assessment. Lhdn e filing guide 2019 Your W-2 may also have been posted online if you and your employer agreed to that method.

Click on Application and then e-Filing PIN Number Application at the left menu. If this is your first time filing your tax through e-Filing dont worry weve got your back with this handy guide on e-Filing. Filing your tax through e-Filing also gives you more time to file your taxes as opposed to the traditional method of filing where the deadline is usually on April 30.

Verify Digital Certificate User Guide. LHDN e-Filing Guide For Clueless Employees The hardest thing in the world to understand is the income tax Albert Einstein 1879 1955 Ill come right out and say it. Since this guide is about e-filing your important dates are.

Download a copy of the form and fill in your details. 8 Using LHDN E-Filing to file your ITRFs. One of our readers dropped us a note stating that the LHDN e-filing PIN can no longer be requested online by mail or by fax any longer as of this year.

First Time Login Tax Agent User Guide. Wednesday 15 May 2019. Hakcipta Terpelihara 2007 Lembaga Hasil Dalam Negeri Malaysia.

Go back to the previous page and click on Next. Form E submission process. 4 2 3 14e-Filing Easy Steps of Get your PIN No.

Tax Season Is Coming Malaysia Business Income Tax Deadlines For 2022

Download Kwsp Income Tax Relief 2019 Gif Kwspblogs

How To Use Lhdn E Filing Platform To File Ea Form Borang Otosection

Ctos Lhdn E Filing Guide For Clueless Employees

Step By Step Income Tax E Filing Guide

Cara Buat E Filing Cukai Pendapatan 2021 Untuk First Timer Mulai 1 Mac

How To Step By Step Income Tax E Filing Guide Imoney

Ctos Lhdn E Filing Guide For Clueless Employees

Ctos Lhdn E Filing Guide For Clueless Employees

Here S A How To Guide File Your Income Tax Online Lhdn In Otosection

Ctos Lhdn E Filing Guide For Clueless Employees

How To Step By Step Income Tax E Filing Guide Imoney

Ctos Lhdn E Filing Guide For Clueless Employees